Welcoming a new child is an exciting and joyful time. While adjusting to the joys and challenges of parenting, one of the things you don’t want to forget about is planning for their future – and more specifically their education. One of the easiest and most effective ways to prepare for your child’s future is by opening a Registered Education Savings Plan (RESP) to help you save for your child’s tuition, school supplies, housing, and more. Withdrawals can be made when they begin their post-secondary journey. Let’s explore how an RESP can be a game-changer for your child’s future.

1. What is a Registered Education Savings Plan (RESP)?

A Registered Education Savings Plan (RESP) is a specialized investment account designed to help parents, family, and friends save for a child’s future post-secondary education. Contributions grow tax-free within the plan, which means the earnings are not taxed until they are withdrawn. This tax deferral allows your savings to grow faster over time.

You can contribute up to a lifetime maximum of $50,000 per child. With the addition of government grants, like the Canada Education Savings Grant (CESG), and tax-deferred growth, your savings can stretch even further. When your child withdraws from the RESP, the income is taxed in their name. Since students usually have lower taxable income, this often results in minimal, or no taxes owed.

2. How to Make the Most of Your RESP

- Start Early

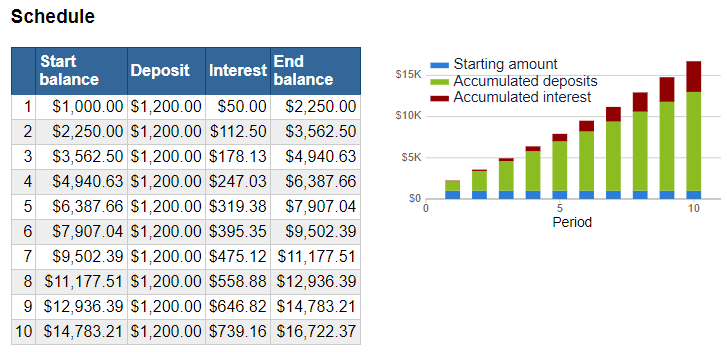

Opening your RESP the younger your child is, the more time your investments have to grow and take advantage of the power of compound interest. Starting an RESP while your child is young gives you more time to save for their future.

- Save What You Can Afford

Contributions don’t have to be large. Every bit counts and even small amounts add up over time!

- Be Consistent

Consistency is key. Set up automatic contributions to stay on track with your savings goals. This ensures regular savings without needing to think about it, which is especially helpful when you have a busy schedule as a new parent.

- Take Advantage of Government Grants

The Canadian government provides the Canada Education Savings Grant (CESG) which contributes 20% annually to the first $2,500 you deposit into an RESP. That could add up to $500 yearly to boost your child’s RESP!

- Know the Limits

The lifetime contribution limit for each RESP beneficiary is $50,000.

- Look into investment Options

- RESPs can hold a range of investments such as Mutual Funds, GICs, or stocks. Meeting with a Mainstreet and Aviso Wealth Advisor can help you choose the right investment based on your goals and risk tolerance.

By following these 6 easy tips you can make the most out of your RESP and set your child up for a bright financial future.

3. Why Should You Open an RESP for Your Child?

Opening an RESP is one of the best ways to give your child a financial head start for their education. With the rising costs of tuition, housing, and school supplies, having dedicated savings can make a significant difference in covering expenses.

RESPs offer a few key benefits:

- Reduce Student Debt: By saving early, you can help your child avoid or minimize student loans, easing their financial stress after graduation.

- Encourage Higher Education: With financial support in place, your child can focus on their studies rather than worrying about tuition costs.

- Tax-Deferred Growth: All earnings and government grants grow tax-free within the RESP, maximizing the impact of your savings.

You can also involve your child in the process by encouraging them to contribute small amounts, such as birthday money or cash gifts. This not only builds their savings but also teaches valuable financial habits early on.

Want to learn more? Speak with a Mainstreet and Aviso Wealth Advisor to explore how an RESP fits into your family’s financial goals.

4. Who Can Open an RESP?

Many people assume that only parents can open an RESP, but that’s not the case. Anyone—including grandparents, aunts, uncles, or even family friends—can open an RESP to help a child save for their post-secondary education.

Additionally, multiple people can contribute to the same RESP account. This makes it an excellent gift option for special occasions, such as birthdays or holidays, where family members can contribute toward a child’s future rather than giving traditional presents.

Not sure which RESP option is right for your family? Speak with a Mainstreet and Aviso Wealth Advisor to explore your options and start planning today.

5. The Power of Compound Interest: Why Starting Early Matters

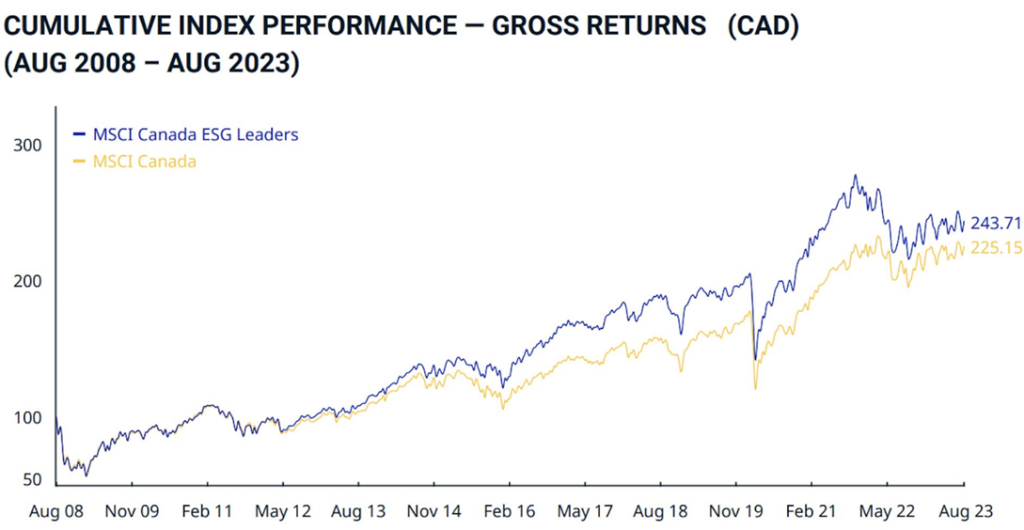

One of the biggest advantages of opening an RESP early is the power of compound interest. Because RESPs combine government-matching grants with your contributions, they grow a little differently than regular savings accounts – maximizing returns over time.

Here’s how starting early can make a big difference:

- If you contribute $200 per month from birth until age 18, assuming a 5% annual return, your child could have $95,494.45 ready for post-secondary education.

- If you wait until your child is 10 years old to start saving with the same monthly contributions and return rate, your investment will grow to only $31,097.25 by age 18—less than a third of the amount you’d have by starting early.

This is the power of compound interest: the earlier you start, the more time your money has to grow. Even small contributions can add up significantly over the years.

Curious as to how much you could save? Try our Education Savings Calculator to explore scenarios tailored to your family’s goals.

6. What About Saving for My Child’s First Car or Home?

An RESP is an excellent way to save for your child’s education, but what about other important milestones, like their first car or home? While RESPs are designed specifically for education savings, a Tax-Free Savings Account (TFSA) can help with broader financial goals.

A TFSA is a flexible savings tool that allows money to grow tax-free and be withdrawn at any time without penalties. This makes it ideal for funding major expenses outside of education.

Key Benefits of a TFSA:

- Tax-Free Growth: Unlike an RESP, which is taxed when funds are withdrawn, a TFSA allows your investments to grow and be withdrawn tax-free.

- No Restrictions: TFSA funds can be used for anything—education, a first car, a down payment on a home, or even travel.

Although your child cannot open a TFSA until they turn 18, you can start saving early by contributing to your own TFSA and later transferring the funds when they become eligible. This strategy helps build a financial cushion for future expenses.

By pairing an RESP with a TFSA, you can set your child up for success in both their education and other key life events.

Want to explore your savings options? Speak to a Mainstreet and Aviso Wealth Advisor to learn how to make the most of both accounts.

Ready to Start Investing?

An RESP is one of the most effective ways to set your child up for future success—helping them afford post-secondary education while reducing financial stress. The sooner you start, the more you can benefit from government grants, compound interest, and tax-free growth.

Take the first step in saving for your child’s future by visiting a branch or booking an appointment with a Mainstreet and Aviso Wealth Advisor today.

Mutual funds and other securities are offered through Aviso Wealth, a division of Aviso Financial Inc. The information contained in this article was obtained from sources believed to be reliable; however, we cannot guarantee that it is accurate or complete. This material is for informational and educational purposes and it is not intended to provide specific advice including, without limitation, investment, financial, tax, or similar matters.