Over the past 25 years, more Canadians have shown a greater interest in incorporating socially responsible investments into their financial plans. Socially responsible investing is becoming a priority for many people as they look to combine their financial growth with a positive social and environmental impact.

Yet, when you hear the term ‘Socially Responsible Investing’, the meaning and impact might remain unclear, or you might wonder, ‘Why does it matter?’. In this blog, we’ll break down what socially responsible investing is, how it works, and highlight its benefits, to help you align your values with your financial goals. Ready to learn how your investments could make a difference? Let’s dive in!

What is Socially Responsible Investing?

Socially Responsible Investing (SRI) is more than just growing your money – it’s about making a difference. SRI is an investment approach that balances financial returns with ethical considerations. This investment approach balances financial returns with ethical considerations by focusing on Environmental, Social, and Governance (ESG) factors.

Key ESG factors that drive socially responsible investing include:

Women in Leadership: Companies with more women on their boards or executive teams tend to perform better on several financial measures; including Return on Equity (ROE), Return on sales (ROS), and stock price growth.

Community Relations: Including Indigenous communities in project planning can lead to more sustainable and ethical business practices.

Executive Compensation: Addressing the wage gap between executive members and their employees fosters equality and builds trust.

Climate Change and Water Scarcity: Companies transitioning to a low-carbon economy and addressing water scarcity are often better poised for the future.

Supply Chain Management: Monitoring workplace conditions in their supply chains helps avoid reputational, legal, and financial risks.

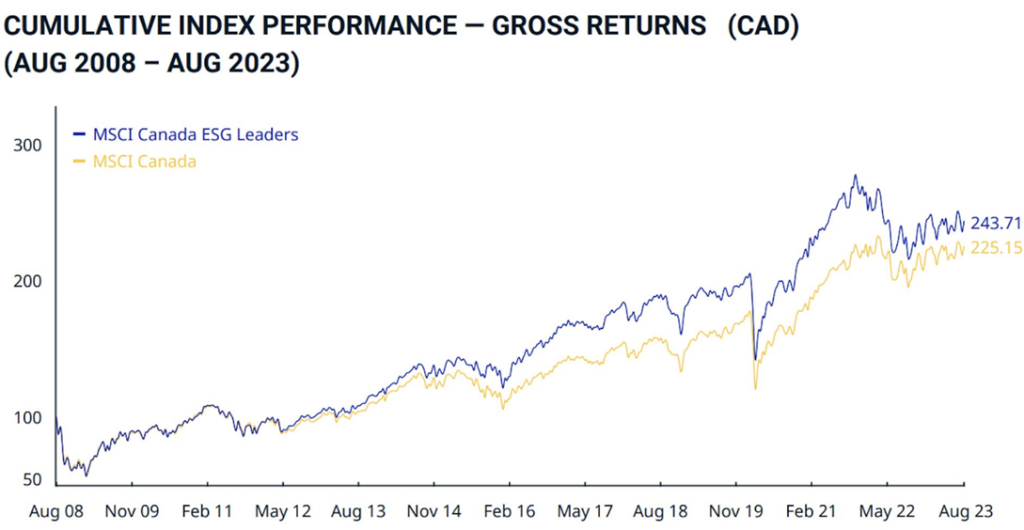

The chart above highlights the performance of return on investments with and without ESG leadership. Take a closer look at the separation from 2014 and on. This highlights investors’ confidence and returns with ESG leadership in recent years.

How Does Socially Responsible Investing Work and What are the Benefits?

Now that we have covered what Socially Responsible Investing (SRI) is, let’s explore how to identify socially responsible investments that align with your values. Here are a few popular strategies to determine which investments meet the ethical and sustainable criteria:

Impact Investing: Investments made in companies or organizations that generate measurable social or environmental benefits alongside financial return. Examples include sectors like healthcare and renewable energy initiatives.

Positive and Negative Screening: This involves selecting or excluding certain industries based on a positive or negative ESG performance. For example, you might include companies focused on clean energy while avoiding industries like tobacco or weapons manufacturing.

Shareholder Engagement: Investors use their influence as shareholders to encourage better corporate behaviour. This could mean voting on key privileges and engaging in discussions with other companies to improve overall ESG performance.

These strategies empower investors to align their values with a more sustainable and ethical future. Want to explore how these strategies could work for you? Speak to a Mainstreet and Aviso Wealth Advisor today.

The Benefits of Socially Responsible Investing as a Mainstreet Member

Incorporating sustainable investing into your financial plan can offer you three distinct advantages:

- Improved Risk Management: Companies with strong ESG practices are often better prepared for regulatory changes and market shifts.

- Contribute to positive societal change: Your investments can drive real change by supporting organizations committed to issues such as climate change or social inequality.

- Enhancing long-term financial performance: Research shows that businesses prioritizing ESG factors often deliver stronger, more resilient financial results over time.

At Mainstreet Credit Union, responsible investing aligns with our core values. We prioritize our members, actively support our local communities, and engage with local businesses. Many of our Mainstreet and Aviso Wealth Advisors hold their Responsible Investment Specialist (RIS) designation from the Responsible Investment Association (RIA). This designation ensures our wealth advisors are well-versed in ESGs and can help tailor your investment portfolio to reflect your values.

When we create your personalized portfolio, we compare options with and without socially responsible investments. This approach allows you to understand the ethical impact of your investments and gives you confidence that your investments are making a difference.

Take the Next Steps

Ready to align your values with your financial goals? Visit your local branch or book an appointment with one of our Advisors.

Whether you’re new to investing, refining your financial plan, or planning for retirement, we’re here to guide you toward a sustainable and ethical investing strategy that meets your needs.

Mutual funds and other securities are offered through Aviso Wealth, a division of Aviso Financial Inc. The information contained in this article was obtained from sources believed to be reliable; however, we cannot guarantee that it is accurate or complete. This material is for informational and educational purposes and it is not intended to provide specific advice including, without limitation, investment, financial, tax, or similar matters.