Many people wonder, “Am I ready to retire?” While there’s no one-size-fits-all answer that automatically makes you “retirement ready”, assessing your financial health is a critical first step. Let’s explore how to plan for the retirement you envision.

How Much Should You Save for Retirement?

Everyone’s retirement lifestyle looks a little different—your vision for the future is the foundation of your retirement plan. To start planning with confidence, ask yourself: Do I want to travel often? Will I downsize or stay in my current home? How much will I spend on hobbies, dining out, or supporting loved ones? Understanding these goals helps you shape a financial strategy that fits the retirement lifestyle you imagine.

The choices you make for your retirement years will directly influence how much you’ll need to save. Being retirement ready means aligning your financial strategy with your personal goals. Once you have a clear picture of what you want, you can turn those dreams into actionable savings targets.

A common rule of thumb for retirement planning is to aim for 70-80% of your pre-retirement annual income. For example, if you earned $70,000 a year before retiring, you’d need around $49,000 to $56,000 annually to maintain a similar lifestyle.

Start by estimating your yearly expenses, including housing, food, travel, healthcare, and leisure activities. Don’t forget to factor in inflation—at an average rate of around 2% per year in Canada, the cost of living tends to rise over time, meaning your savings need to keep pace.

Next, consider where your retirement income will come from. Government programs like the Canada Pension Plan (CPP) and Old Age Security (OAS) provide a base level of income, but they may not cover all your expenses. If you have a workplace pension, it can offer additional financial support. Your personal savings—such as RRSPs, TFSAs, and non-registered investments—will often need to fill the gap to ensure a comfortable retirement.

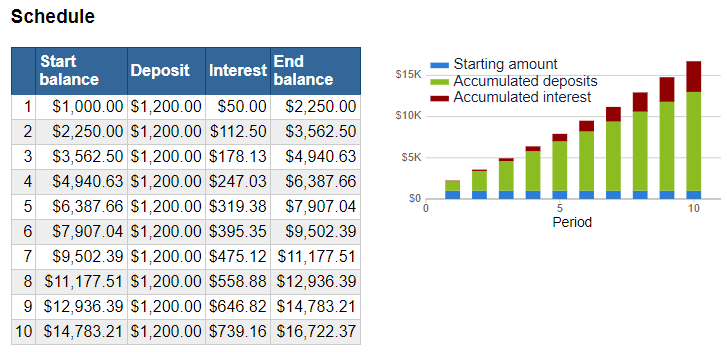

A smart savings strategy is to start early and aim for 10 to 15 times your final working-year income saved by the time you retire. Need help setting your personalized savings target? Try the Mainstreet Credit Union Retirement Planner to map out a plan tailored to your retirement goals.

How Does a Registered Retirement Income Fund Work?

Once you retire, your Registered Retirement Savings Plan (RRSP) must convert into a Registered Retirement Income Fund (RRIF) by the end of the year you turn 71. Here is how it works.

RRIFs require minimum annual withdrawals starting the year after they’re set up. The withdrawal percentage increases with age (5.28% at 71, 6.82% at 80). For instance, if you have $200,000 in an RRIF at age 71, you’ll need to withdraw at least $10,560 annually (5.28%). Because RRIF withdrawals are fully taxable, it’s important to carefully plan how much you take out each year to help reduce taxes during your retirement. Balancing your RRIF withdrawals with other income sources minimizes taxes and stretches your savings. Try out our RRIF Calculator to estimate your annual withdrawal.

If you’re married consider a Spousal RRSP if your partner earns less. This enables income splitting in retirement, reducing your combined tax burden.

The Role of an Emergency Fund in Retirement

An emergency fund is a safety net, it is necessary even after you stop working and key component of your retirement plan. Unexpected expenses such as medical bills, home repairs, or family emergencies can arise, and you’ll want quick access to funds without dipping into long-term investments.

How much should be in your emergency fund? Saving 3-6 months of essential living expenses is a great base for your emergency fund. Keeping the funds liquid and accessible in a high-interest savings account is great for any unexpected expenses that could arise.

An emergency fund is important when unexpected expenses arise, without an emergency fund, you may need to withdraw extra funds from your RRIF or sell investments during market downturns, which can jeopardize your long-term financial security.

Are You Truly Retirement Ready?

Here are some key questions to ask yourself to assess if you are ready to retire.

- Do I know my expenses? Have you accounted for all potential costs, including inflation and healthcare?

- Do I have enough savings? Have you calculated how long your savings will last based on your desired lifestyle?

- Have I balanced my income streams? Are you maximizing CPP, OAS, workplace pensions, RRSPs, TFSAs, and other personal savings?

- Am I tax-efficient? Have you optimized RRIF withdrawals, TFSAs, and income splitting to minimize taxes?

- Do I have a contingency plan? Is an emergency fund in place for unexpected costs that may arise?

Retirement readiness isn’t just about reaching a savings goal—it’s about understanding your needs, leveraging income sources, and preparing for the unexpected.

If you’re unsure if you are retirement ready book an appointment with one of our wealth advisors to create a tailored plan that ensures peace of mind in your retirement years.

Mutual funds and other securities are offered through Aviso Wealth, a division of Aviso Financial Inc. The information contained in this article was obtained from sources believed to be reliable; however, we cannot guarantee that it is accurate or complete. This material is for informational and educational purposes and it is not intended to provide specific advice including, without limitation, investment, financial, tax, or similar matters.