Are you thinking about buying a home? Before browsing through listings or attending open houses, there is one important step to take: getting a mortgage pre-approval. It’s quick, seamless, and gives you a major advantage in today’s competitive housing market by showing sellers you’re financially ready.

A mortgage pre-approval is more than just a formality; it shows sellers that you’re serious, helps you set a clear price range, and protects you from rate increases while you shop. Not to be confused with pre-qualification, which is a more informal estimate based on unverified information, a pre-approval is based on verified financial documents and gives you a stronger position when making an offer.

In this blog, we’ll walk you through the 3 simple steps to get pre-approved for a Mainstreet Mortgage so you can confidently move forward knowing exactly what you can afford.

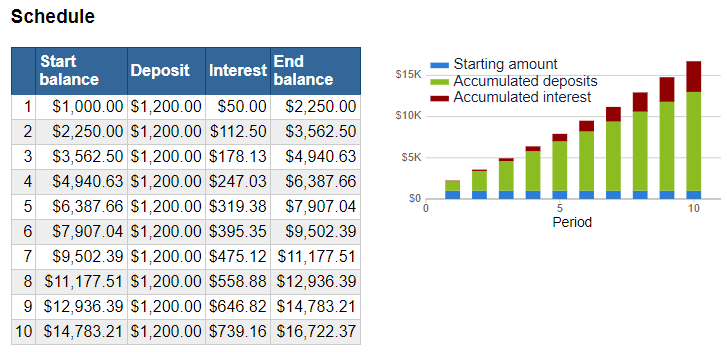

Want to get a head start? Use our mortgage calculator to get a mortgage pre-approval estimate before your appointment. It’s a great way to see how much you might qualify for and prepare for your homeownership journey.

Step 1: Book an Appointment

The first step to a successful home purchase is booking an appointment with a Mainstreet Advisor. Our team provides personalized financial advice to help you find the mortgage that’s right for you, making the process smooth and stress-free. You can meet with an advisor in person at your local branch or book a virtual appointment—whichever works best for your schedule. Either way, you’ll be supported every step of the way.

Book an appointment today to get started on the path to pre-approval and homeownership.

Step 2: Gather the Necessary Documents

After you have booked your pre-approval mortgage appointment, the next step is to gather the documents our advisors need to assess your financial picture. This helps ensure your mortgage pre-approval is accurate and reflects what you can comfortably afford.

Here is what you need to bring.

- Proof of income – T4s and recent pay stubs

- If you’re self-employed – your last 2 years of Tax Returns and 2 Years of Notice of Assessments

- Asset Information – such as vehicles, other properties, or investments.

If you’re buying with a partner, each of you must provide the documents listed above.

Having everything ready in advance ensures your advisor can complete your pre-approval efficiently, saving time and avoiding delays. Download our mortgage pre-approval checklist to help stay organized.

Step 3: Get insights and expert advice

Now that your documents are ready, it’s time to meet your Mainstreet Advisor. During this appointment, you’ll receive expert guidance tailored to your financial goals, including:

- Your mortgage approval amount

- Interest rates and available terms

- The length of your mortgage (amortization)

- Types of mortgages – such as fixed, variable, or open – so you can choose the best fit

Our advisors will also walk you through how your mortgage amount + down payment = your maximum purchase price, so you’ll know what homes are within your reach. And with Mainstreet, you get more than just a great rate; your advisor will explain the additional perks of a Mainstreet mortgage. The benefits include:

- Prepayment options to help you become mortgage-free sooner

- Flexible payment schedules

- A free chequing account

- And more

Once you have the pre-approval in hand, you can confidently put it towards the purchase of your property. Mainstreet holds rates from the pre-approval application for a total of 90 days, and after that, we would have to change the rate and re-approve the application in process. And if rates go down in the first 90 days after you get your mortgage, you will automatically get the lower rate.

What Happens Next?

Once you’ve found the right home and your offer is accepted, your Mainstreet advisor will finalize your mortgage application using the property details. This turns your pre-approval into a full mortgage approval, so the funds are ready when you need them.

A preapproval for a house can make a big difference when it’s time to make an offer, as it shows the seller you’re serious and financially prepared.

At Mainstreet, we’re committed to making the process, from the first appointment to the time you get the keys to your new home, as seamless and stress-free as possible.

Ready to get started? Book an appointment or visit a local Mainstreet Credit Union branch to meet an advisor and take the first step toward homeownership. Whether you’re buying your first home or planning your next move, getting pre-approved is a powerful step toward your homeownership goals. Let’s make the journey simple, together.