You’ve spent countless hours drafting, researching, and refining your business plan. Congratulations, you’re one step closer to your entrepreneurial dream! Now, how do you start a business, what do you do with your business plan? Having a business plan is just the beginning. Now, it’s time to put it into action.

A business plan is like a blueprint; it’s only effective if it is followed, executed, and adjusted as you move forward. So, after creating your business plan, what is the next step?

Here are the steps next to turn your business plan from paper into profit.

- Test The Business

- Conduct Surveys & Focus Groups

- Secure Funding

- Develop & Execute Your Marketing Plan

- Track Progress and Adjust

Test the Business

Even the best-crafted business plans can hit bumps when they are put into action. A great idea can sometimes have challenges translating in the market. So once your business plan is complete, it is important to test your plan in the real world with real customers. This step allows you to fine-tune your approach early before committing more time and resources.

Offering limited runs or trials to early adopters helps you refine your product and business approach and is an important step when you start your business. It is important to evaluate the pilot tests and understand what worked, what didn’t work, and what can be changed to work better. Early testers and adopters are also crucial for creating buzz and word-of-mouth marketing, so it is important to leave a good first impression during this period.

Conduct Surveys and Focus Groups

Getting feedback on your idea directly from your target audience is vital. Surveys, interviews, or focus groups can reveal opportunities or pain points you might have missed in your initial feedback. Determining what you want to get feedback on is a great first step in creating a survey or focus group. You can ask a series of targeted questions to get the answers you need to create actionable insights on specific areas. Gathering and incorporating your feedback can also help you realize what you are doing well, what needs adjusting, and what the market needs. Collecting feedback will give you confidence as you move forward knowing that your small business resonates with people.

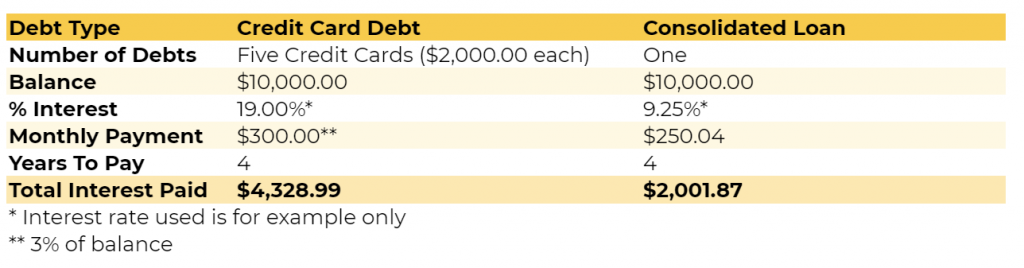

Secure Funding

If your business requires capital, securing the right funding is essential. There are a number of ways to gain additional funds, and knowing which one is right for you can sometimes feel a little overwhelming. At Mainstreet, our Commercial and Agricultural Account Manager‘s are available to help you with a range of lending options tailored to your specific needs. They will be able to work with you to review your financial situation and recommend the best funding solutions to meet your goals. Book an appointment today to learn more about the options available to you. .

In addition, there are also a range of grants or community resources that may be available to you. We encourage you to connect with your local Small Business Enterprise Centre and Community Futures location, or visit the province of Ontario website. Grants can be a great resource that you could utilize to kickstart your business!

Remember, maintaining ongoing financial health is key to sustaining your business long-term and beyond the initial funding.

Develop Your Brand and Execute Your Marketing Plan

A brand is more than just a logo, it is the story behind your business and how you connect with customers. Having a plan on how to share that story and separate yourself from the competition is crucial. To create an effective marketing plan, it is important to understand where your customers are and the best way to reach them. Developing a website and digital footprint is usually a great low cost first step to help make your business easily found and have conversations with customers. Mapping out a plan that is based on research and aligned to your brand can go a long way in establishing your business, especially if you are just starting out.

Track Progress and Adjust

Being a successful business owner means staying flexible and adapting quickly when necessary. Even with a solid business plan, it’s essential to monitor your progress and be ready to pivot when needed. Market conditions and customer preferences can shift, and if your business isn’t performing as expected, it doesn’t mean your idea isn’t viable—it might just need some fine-tuning or better timing. Whether you’re seeking financing or just want a strategic check-in, our team is here to support you.

Starting and growing a business demands ongoing learning, flexibility, and persistence. Each step you take after creating your business plan moves you closer to achieving your small business goals. Don’t hesitate to seek advice, reassess your strategy, and celebrate each milestone along the way.

At Mainstreet, we’re committed to being your partner on this journey. Book an appointment today with one of our Commercial and Agricultural Account Managers to explore how we can help you meet your goals and grow your business with confidence. We’re here to provide the support and solutions you need—let’s take the next step together.